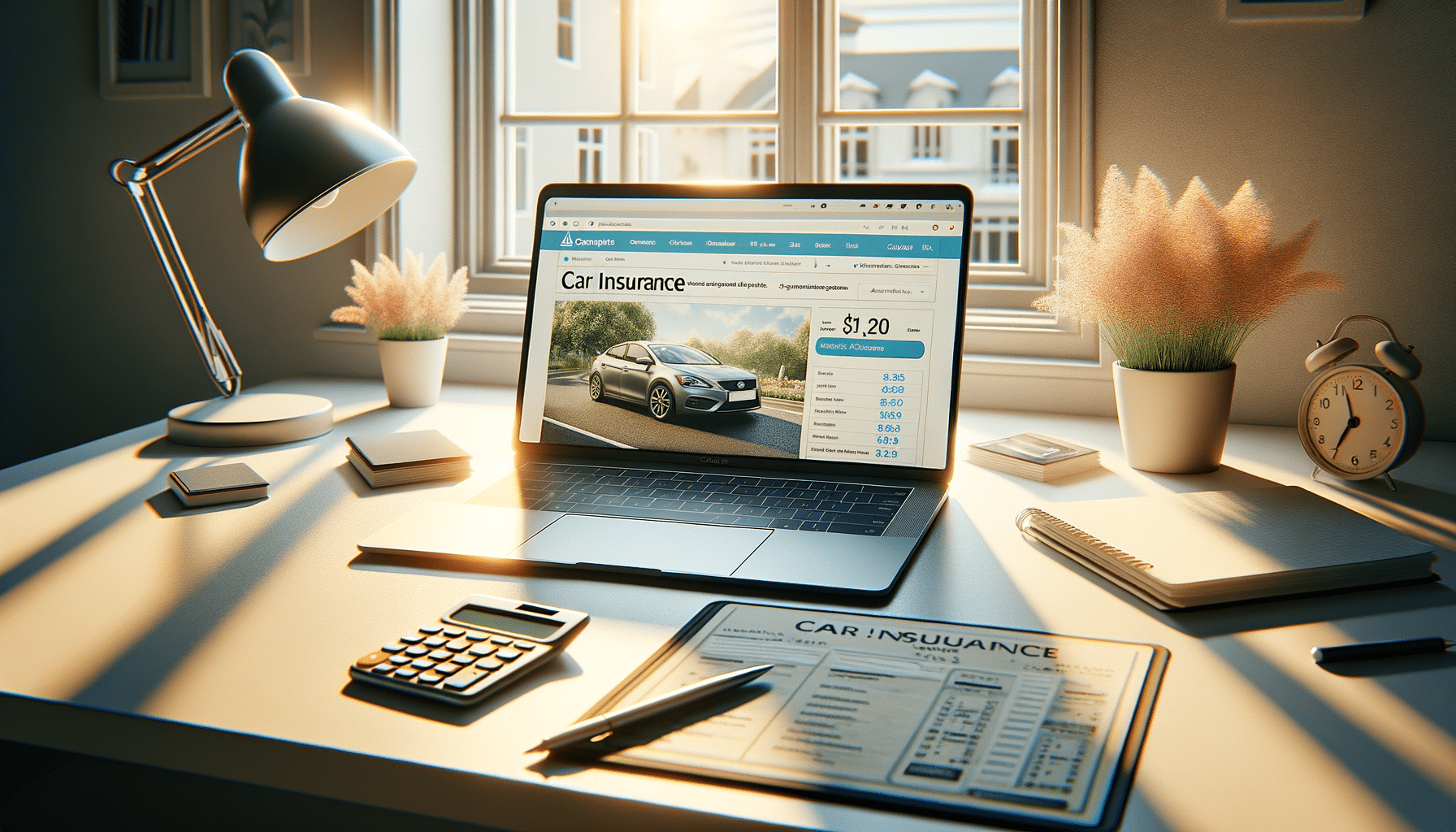

Compare Car Insurance Quotes In Minutes

Introduction to Car Insurance Quotes

Finding the right car insurance can be a daunting task, especially with the myriad of options available in the market. Understanding the intricacies of car insurance, including coverage, premiums, and discounts, is essential for making informed decisions. This article delves into these critical aspects, offering insights into how to compare car insurance quotes efficiently and find the most suitable policy for your needs.

By exploring the elements of coverage, premiums, and discounts, you can navigate the car insurance landscape with confidence. Whether you are a new driver or looking to switch providers, understanding these components will help you secure a policy that offers both value and peace of mind.

Understanding Coverage Options

Car insurance coverage is a fundamental aspect of any policy. It determines the extent of protection you receive in the event of an accident or other covered incidents. Coverage options can vary significantly between providers, making it crucial to compare them carefully.

Common types of coverage include:

- Liability Coverage: This is often mandatory and covers damages to other people and property in an accident you cause.

- Collision Coverage: Pays for damages to your vehicle resulting from a collision with another car or object.

- Comprehensive Coverage: Protects against non-collision-related incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection: Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who lacks sufficient insurance.

Each type of coverage offers different levels of protection, and selecting the right combination is vital. Consider your driving habits, vehicle type, and personal preferences when choosing coverage to ensure you are adequately protected without overpaying.

Decoding Premiums

Premiums are the amounts you pay for insurance coverage, typically on a monthly or annual basis. They are influenced by various factors, including your driving record, age, location, and the type of vehicle you drive. Understanding how premiums are calculated can help you find a policy that fits your budget.

Several factors affecting premiums include:

- Driving History: A clean driving record often results in lower premiums, while accidents and violations can increase costs.

- Vehicle Type: Luxury or high-performance vehicles may attract higher premiums due to their repair costs.

- Location: Urban areas with higher accident rates typically have higher premiums than rural locations.

- Credit Score: In some regions, insurers use credit scores to assess risk, with higher scores potentially leading to lower premiums.

- Coverage Limits: Higher coverage limits can increase premiums but offer greater protection.

To manage premiums effectively, consider adjusting your coverage limits, opting for higher deductibles, or exploring multi-policy discounts. Regularly reviewing your policy and comparing quotes can also help you find competitive rates.

Exploring Discounts

Discounts play a significant role in reducing car insurance costs. Insurance providers offer various discounts based on factors like driving behavior, vehicle safety features, and loyalty. Understanding available discounts can lead to substantial savings on your premiums.

Common discounts include:

- Safe Driver Discount: Available to drivers with a clean driving record for a specified period.

- Multi-Policy Discount: Offered to customers who bundle multiple insurance policies, such as home and auto insurance, with the same provider.

- Good Student Discount: For young drivers who maintain a certain GPA, reflecting responsible behavior.

- Safety Features Discount: Vehicles equipped with safety features like anti-lock brakes or airbags may qualify for discounts.

- Loyalty Discount: Long-term customers may receive discounts for renewing their policies with the same provider.

When comparing insurance quotes, inquire about available discounts and eligibility criteria. Taking advantage of these savings opportunities can significantly reduce your overall insurance expenses.

Conclusion: Making Informed Choices

Comparing car insurance quotes is a vital step in finding the right policy. By understanding coverage options, premiums, and available discounts, you can make informed decisions that align with your financial goals and protection needs. Regularly reviewing your policy and staying informed about industry changes can ensure you maintain optimal coverage at competitive rates.

Remember, the key to securing affordable car insurance lies in thorough research and comparison. Utilize online tools and resources to gather quotes from multiple providers, and consult with insurance professionals to clarify any uncertainties. With the right knowledge and approach, you can confidently navigate the car insurance market and secure a policy that offers both value and peace of mind.