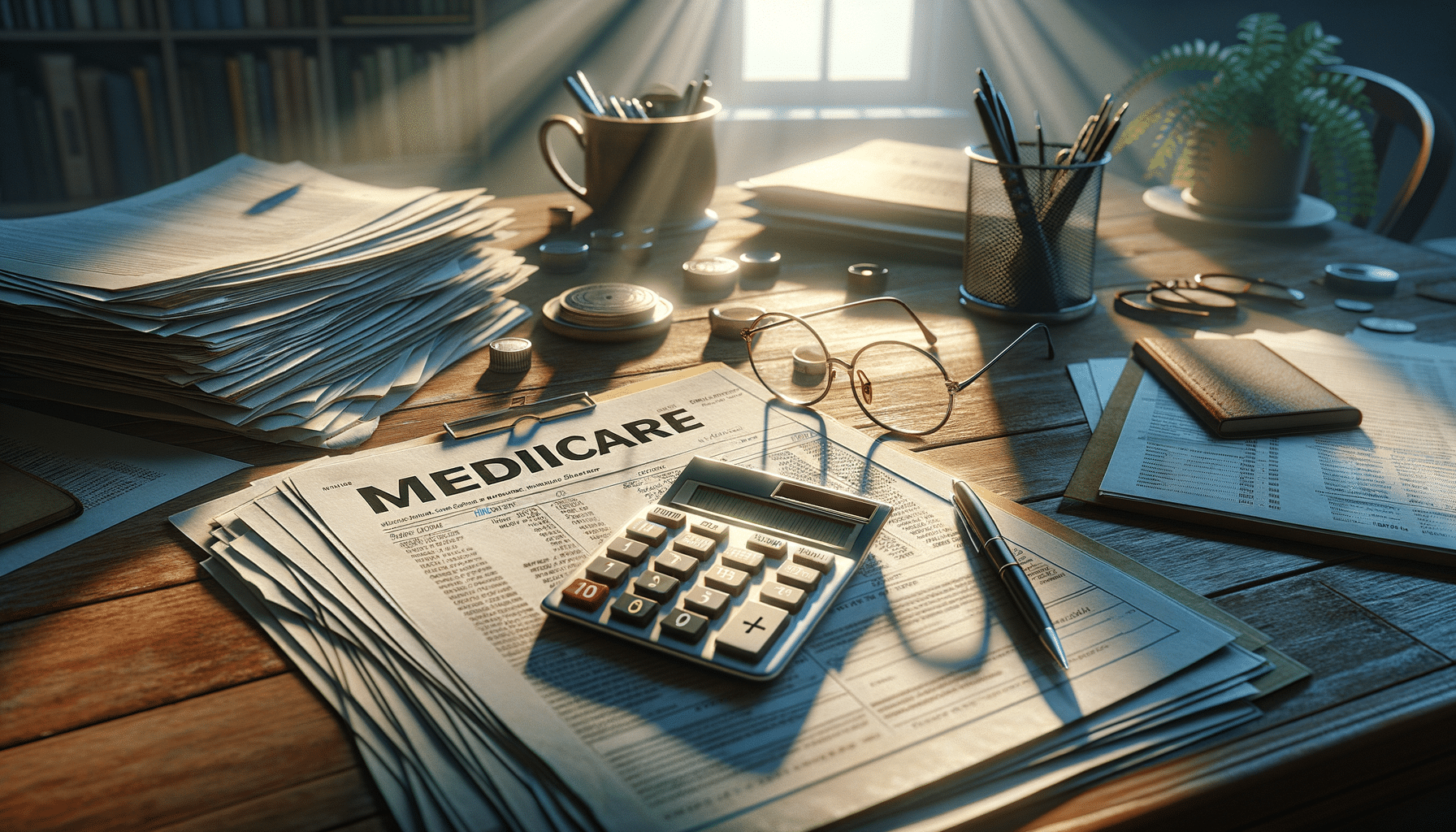

New To Medicare? Learn About Supplement Plans

Introduction to Medicare Supplement Plans

Understanding Medicare can be complex, especially for those new to the system. Medicare Supplement Plans, also known as Medigap, play a crucial role in enhancing the original Medicare coverage. These plans are designed to fill the “gaps” left by Medicare Parts A and B, covering costs like copayments, coinsurance, and deductibles. Their importance cannot be overstated, as they provide beneficiaries with financial protection and peace of mind.

Medicare Supplement Plans are offered by private insurance companies and are standardized across most states, meaning the benefits of each plan are consistent regardless of the provider. This standardization ensures that beneficiaries can make informed decisions based on their healthcare needs and financial situations without worrying about variations in coverage. As we delve deeper into the specifics of coverage, enrollment, and benefits, it becomes clear why these plans are a valuable asset for many Medicare recipients.

Understanding Coverage in Medicare Supplement Plans

Coverage under Medicare Supplement Plans is extensive, providing a safety net for many out-of-pocket expenses not covered by original Medicare. These plans are designed to cover costs that can quickly accumulate, such as hospital stays, skilled nursing facility care, and emergency healthcare during foreign travel.

One of the key advantages of these plans is their ability to cover Part A and B coinsurance and copayments. This includes hospital costs up to an additional 365 days after Medicare benefits are exhausted, which can be a significant relief for those facing extended hospital stays. Additionally, Medicare Supplement Plans often cover the first three pints of blood needed for a medical procedure, a cost that would otherwise fall on the patient.

For those who frequently travel abroad, certain Medicare Supplement Plans provide coverage for emergency healthcare services outside the United States. This feature ensures that beneficiaries are not left vulnerable when traveling, offering peace of mind and financial protection no matter where they are. By understanding the breadth of coverage offered, beneficiaries can select a plan that aligns with their healthcare needs and lifestyle.

Enrollment Process of Medicare Supplement Plans

Enrolling in a Medicare Supplement Plan requires careful consideration and timing to ensure maximum benefits. The ideal time to enroll is during the Medigap Open Enrollment Period, which begins the first month a beneficiary is 65 and enrolled in Medicare Part B. This period lasts for six months and provides the most favorable conditions for securing a plan.

During this open enrollment period, beneficiaries have a guaranteed issue right, meaning they can purchase any Medigap policy available in their area without medical underwriting. This ensures that individuals with pre-existing conditions are not charged higher premiums or denied coverage based on their health status.

Outside of the open enrollment period, obtaining a Medicare Supplement Plan can be more challenging, as insurers may require medical underwriting. This could result in higher premiums or even denial of coverage. Therefore, understanding the enrollment process and timing is crucial for securing a plan that meets individual needs and financial circumstances.

Benefits of Medicare Supplement Plans

The benefits of Medicare Supplement Plans extend beyond financial savings, offering beneficiaries a sense of security and stability in their healthcare coverage. One of the most significant advantages is the predictability of healthcare expenses, as these plans cover many out-of-pocket costs that can be unpredictable and burdensome.

Additionally, Medicare Supplement Plans provide flexibility in choosing healthcare providers. Unlike some Medicare Advantage Plans, Medigap plans do not restrict beneficiaries to a network of doctors and hospitals, allowing them to seek care from any provider that accepts Medicare. This flexibility is particularly beneficial for those who travel frequently or live in areas with limited healthcare options.

Moreover, the standardization of benefits ensures that regardless of the insurance company offering the plan, beneficiaries receive the same coverage. This transparency allows individuals to focus on selecting a plan based on their specific needs and financial considerations rather than navigating complex variations in coverage. Overall, the benefits of Medicare Supplement Plans make them an attractive option for those seeking comprehensive and reliable healthcare coverage.

Conclusion: Making Informed Decisions

Choosing a Medicare Supplement Plan is a significant decision that requires careful evaluation of one’s healthcare needs, financial situation, and long-term goals. By understanding the coverage, enrollment process, and benefits, beneficiaries can make informed choices that enhance their original Medicare coverage and provide peace of mind.

Medicare Supplement Plans offer a valuable solution for managing out-of-pocket expenses and ensuring access to quality healthcare without the added stress of unexpected costs. As individuals approach the age of 65 or consider switching plans, it is essential to review available options and consult with knowledgeable professionals to secure a plan that best suits their needs.

Ultimately, the right Medicare Supplement Plan can transform the healthcare experience, providing security and stability for beneficiaries and their families.